Double Entry for Provision for Doubtful Debts

We calculate it after deducting bad debts and provision for bad debts from the debtors. It would not be a proper disclosure to disclose provision for doubtful debts under the head Current liabilities and provisions.

Bad Debt Provision Accounting Double Entry Bookkeeping

Journal Entries in Case of Bad Debt and.

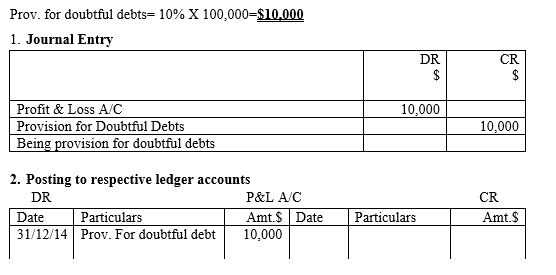

. Journal Entry Date Detail DR CR 31 Dec Profit and loss ac Provision for doubtful debts account 47500 47500 An extract from the profit and loss account for year ended 31 December 2004 would show. The other side would be a credit which would go to the bad debt provision expense account. The format of balance-sheet also requires provision for doubtful.

To Provision for Bad and Doubtful Debts. A firm creates it to encourage the debtors towards early payments of debts. The Journal entry for this would show.

Increase in provision for doubtful debts 10 10 000 800 200. Being the provision made for Doubtful Debts Debit to the profit and loss Account will reduce profit for the current year by the amount of provision. Calculate closing blc towards provision for doubtful debts and pass journal entry to the provision maintained.

Thats all you get for now. During year 10000 written off as bad debt. CR Provision for doubtful debts.

The provision for doubtful debts is 50. When an amount becomes irrecoverable from debtors the amount is debited to the Baddebts account and credited to the personal account of the debtors. Double Entry for Bad and Doubtful Debts Question 1 pg 80 A businessman has an amount of Trade receivables 20500 outstanding as on 31 December 2005 which includes an amount of 500 due from a customer who has been declared bankrupt.

Decrease in Provision of Doubtful Debts. Trade receivables 10 000. A provision for doubtful debts of 10 is maintained.

For the provision the double entry is dr bad and doubtful debts in profit or loss and cr provision for doubtful debts. Bad Debts. The journal entry for this adjustment will look like this.

Bat family x reader. The provision is used under accrual basis accounting so that an expense is recognized for probable bad debts as soon as invoices are issued to customers. To provision for Doubtful Debts Ac.

To reduce a provision which is a credit we enter a debit. A general allowance of 2000 50000-10000 x 5 must be made. What is the entry for bad debts provision.

Ie Current assets at 11113. In the Balance Sheet include the provision for doubtful debts for the year which is 150. Provision for doubtful debts double entry.

Creating a Provision for doubtful debts for the first time. But the actual amount of bad debts relating to the current year would only. The Provision for Bad and Doubtful Debts will appear in the Balance SheetNext year the actual amount of bad debts will be debited not to the Profit and Loss Account but to the Provision for Bad and Doubtful Debts Account which will then stand.

As a general allowance of 1500 has already been created only 500 additional allowance must be charged to the income statement. Debit Profit and Loss Account. CR Provision for doubtful debts.

Provision for doubtful debts is a provision against a possible loss. The entry for creating provision for doubtful debts is debit and credit provision for doubtful debts account. Provision for doubtful debts.

Opening provision for doubtful debts is 51000. The double entry would be. Best pregnancy doctor near me.

Credit Provision for Doubtful Debts Account. A provision for doubtful debts of 10 is to be created. We would love to personalise your learning journey.

Provision for doubtful debts 800. Therefore it should only be disclosed as a deduction from sundry debtors. Increase in Provision for doubtful debts.

Difference between h11 and h13. The amount of provision is carried forward to the next year. The provision for doubtful debts will give you a balance figure to reduce the debtors fiqure you put in the current assets line by line.

The provision for doubtful debts which is also referred to as the provision for bad debts or the provision for losses on accounts receivable is an estimation of the amount of doubtful debt that will need to be. It is identical to the allowance for doubtful accounts. If you struggle to follow those entries may I ask you to check the free F3 lectures on the subject of bad and doubtful debts accounting.

The entry for creating provision for doubtful debts is debit and credit provision for doubtful debts account. These means which will be receivable or cannot be ascertainable at the date of preparing the financial statements. Link centre car boot sale swindon.

It wasdecided to write off this amount as bad debts. Unlike bad debt doubtful debt isnt officially uncollectible debt. In simple words those debts are doubtful to realize.

What is the double entry for provision for Doubtful Debts. Closing debtors is 630000decided that 10 of debtors is to be maintained as provision. Trade receivables 10 000.

The amount of debtors for the year totaled to 1000. Graton casino slots tight. Allowance for Doubtful Debts Balance Sheet 500.

Sign Up to explore more. But this is not sufficient. These means which are not bad ie neither there is the possibility of bad debts nor any doubt about their realization is known as good debts.

The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. Accounting treatment for provision for doubtful debts. To reduce a provision which is a credit we enter a debit.

The double entry would be. Amount increased should be calculated. Allowance for Doubtful Debts Expense 500.

At the end of the year the list of debtors may still contain some debts which are doubtful of recovery. Provision for doubtful debts 10 10 000 1 000.

Accounting Nest Intermediate Bad Debts And Provision For Doubtful Debts

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Comments

Post a Comment